Table of Contents

ToggleHow to download palmpay App for all.

One of the trending and reliable online banking platform in Nigeria at the moment is Palmpay. Having a palmpay app on your smartphone is a major boost to your online financial activities, since it’s fast, reliable and easy to operate.

With Palmpay you can, save, invest, get loans and even earn with it. In this post, we will help you know the best way to download and use your Palmpay account in Nigeria.

Introduction

The stress of having to go to the bank, is greatly affecting our time schedule, why waste time and resources going to the bank when you can do it with your smartphone via Palmpay.

As we all know the financial services and mobile payment software Palmpay has become a very popular financial platform, especially in Nigeria and other African nations. So we deem it fit to write a very comprehensive post on how to download, save and invest on palmpay.

Since they started operation in Nigeria, Palmpay has made great progress towards offering a variety of financial services to its consumers, including bill payment, mobile payment, and even the chance to invest and make profit. If you are looking for an safe place to save your money, then you should probably download Palmpay app.

So I advise you to check the most recent information for the most recent updates, as the app’s features and offerings may have changed or evolved since then. That is why this post is written to help you know the best Palmpay app to download for your Android device.

About Palmpay

Palmpay is one of the best online financial platform for savings and other financial services, with branches in most cities in Nigeria.

Due to its ease, reliability and security, Palmpay is a flexible mobile payment and financial services software that has grown in popularity.

They also do virtually everything a normal commercial banks will do. Users can pay bills, transfer money, make payments, and even access financial services like loans and savings accounts with ease using Palmpay.

For many people in the world of digital payments, its user-friendly design and strong security measures make it the preferred option.

Palmpay makes financial management, paying for a meal, or sending money to a friend easier. It’s a reliable partner for contemporary, cashless transactions.

Read : How to borrow money from palmpay (5 Easy Steps)

It’s worth noting that the competitive landscape for mobile payment apps is continually evolving, with various players entering the market. In all these Palmpay still stands tall as one of the best in terms of online banking platform.

Don’t fall prey to those scammers online, not all online financial apps are legit. So you would be careful when dealing with some of these online financial apps.

If you really want an online financial app, then I recommend you use Palmpay app.

Palmpay app features

Before we discuss on how you can download this Palmpay app, let’s first of all know the basic features of the Palmpay app.

Below are some of the basic of the Palmpay apps,

1. Investment opportunities

Since they started operation in Nigeria, palmpay has been providing a lots if business opportunities to Nigerians. This features has helped Nigerians save and grow their wealth with time.

Business such as, Palmpay agents and even becoming a POS service provider

2. Bill payments

Paying of bills has always been a routine in Nigeria, bils like, Nepa, water and the rest of them can now be paid easily with your Palmpay account.

With Palmpay you can easily pay your utility bills, this reduced the stress and time wasted by going to the payment physical office

3. Bill payment

This is one of the main reasons you should have a palmpay account, since it enable you pay bills easily.

Since palmpay allows users to make mobile bill payment, you can use your palmpay account to make payments for shopping and other payments.

This helps reduce the risk of moving around with cash. This will help you where you are running a cashless economy.

4. Airtime Top- Up

Instead of going out to buy airtime for your phone why not get a direct top up from your Palmpay account.

Having to top up your line from your Palmpay account will help save you some time, energy and the risk of going out.

5. Cross-border transaction

Due to the presence of palmpay in other African countries, this enables you to send and receive funds around countries in Africa. This is only possible with Palmpay.

How to download Palmpay App

Like I said earlier Palmpay is a financial online app that allows you to open, send and receive funds. Not only that, you can also pay bills, top up your airtime send and receive money across Africa.

What are you still waiting for, download and open an account with the Opay platform, palmpay is reliable and it’s been licensed by the Central Bank of Nigeria and insured by NDIC.

You have nothing to worry about when you open an account with Palmpay since it’s reliable.

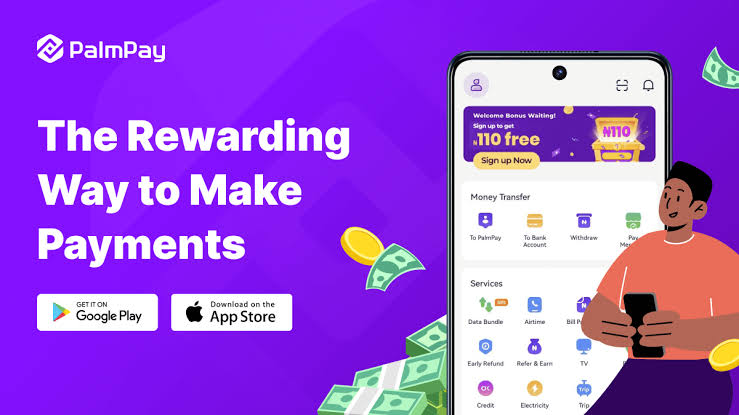

With lots of amazing bonuses you will get on Palmpay why not download the Palmpay app and enjoy.

Here is how to download the Palmpay app

Palmpay is available on both Android and IOS devices, so whatever phone you are using, you can download and have a Palmpay account.

So to download a Palmpay account, you will have to follow these simple steps

1. Download the Palmpay app on Play Store

If you are using an Android phone, you should quickly visit the Play Store, on the search box type in Palmpay and it will be displayed on your screen.

Click on the install button and then wait for it to download and install automatically.

2. Launch Palmpay and signup

After the PalmPay app has been installed, open it by clicking the icon. At the bottom of the screen, you’ll find four options. Select Me, then hit the sign-up button. After completing the sign-up process, you will receive a complimentary N200 incentive.

You must provide your phone number in order to register (a verification SMS will be issued to the number) > Legal Initial and Last Name, After choosing your gender and birthdate, click the “sign-up” button. Proceed to the next step after finishing.

3. Verify KYC

The final step is rather simple: after creating your account, you must complete KYC, which requires submitting your BVN, NIN, and any other required documentation that verifies your identity as a PalmPay user.

In conclusion, Palmpay has proven itself as a versatile and user-friendly financial app, offering a wide range of services from mobile payments to airtime top-ups. Its seamless interface and commitment to security make it a standout choice in the crowded fintech landscape. That is the more reason you should download the palmpay app.

With the convenience it brings to everyday financial transactions, Palmpay simplifies banking and enhances the financial lives of its users, making it a valuable addition to the digital payment ecosystem.

Palmpay App for Iphone

Yes the Palmpay app is available on the Apples IOS store, as an apple phone user in Nigeria you can now download Palmpay.

Is Palmpay licensed by CBN

Many people are afraid to bank with palmpay a they are still in doubt whether it’s legit. To cure your curiosity, yes Palmpay is licensed by CBN and also insured by NDIC, meaning your money is In save hands.

The CBN-certified fraud and security system helps ensure that your money and details are protected.

Palmpay apps for Android

With the Google Play Store, you can also download and install the Palm Pay app to enable you to save and receive money.

Related posts

How to become an Opay agents in Nigeria

How to check First Bank BVN code